THE MANDALIKA SPECIAL ECONOMIC

ZONE AND OUR TURTLE REEF PENINSULA

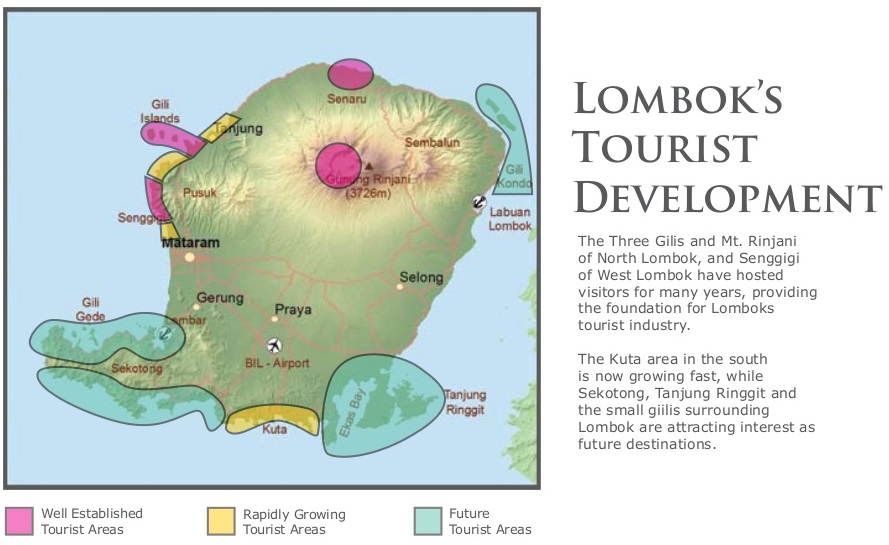

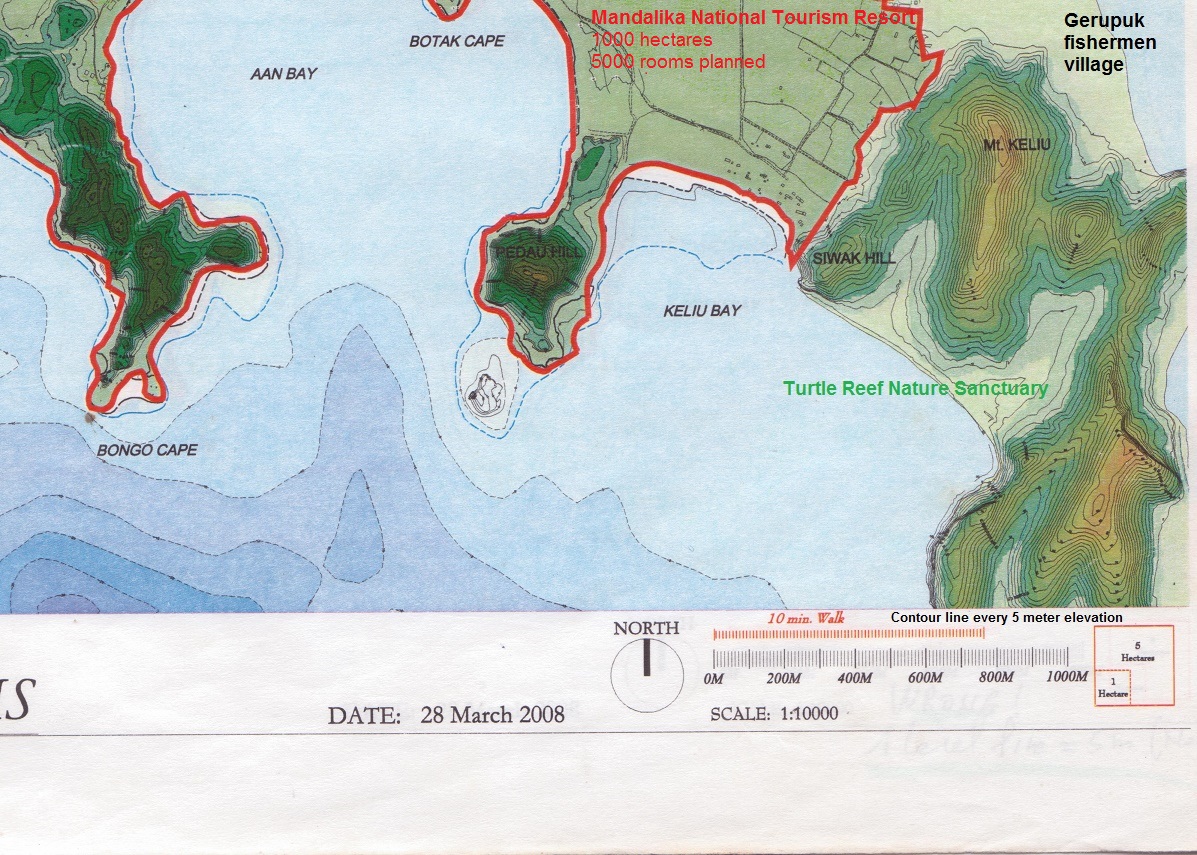

The four pictures

hereabove describe the Lombok island and the 1200+ hectare

Mandalika National Tourism Resort.

Turtle Reef's lands constitute a

100 hectare highland peninsula tucked between the Kuta &

Gerupuk villages, 1500m eastward from the famous Tanjung Aan bay

where a golf course and a couple of five star hotels shall break

ground by 2018. Infrastructure like 4 lane roads, power and water

are now available at just 500 meter from Turtle Reef.

Turtle Reef's hills are the ONLY freehold

oceanfront lands neighboring the national resort (all other lands

surrounding Mandalika are either non-oceanfront freeholds, or

oceanfront lands belonging to the Ministry of

Forestry).

Mandalika is now being leased (30 year

contracts) to hotels and other operators by the Indonesian

state-owned company PT ITDC (of Nusa-Dua Bali's fame).

After the

groundbreaking ceremony on December 12, 2015 by the Vice-President

of Indonesia, a 350 room Club Med resort, a 250 room Pullman,

a Royal Tulip, and a X2 are the first four hotels built being built

for a total of 1200 rooms (including the worldly acclaimed Novotel

hotel designed by Bill Bensley in 1995). As many as 20 hotels and

5000 rooms are planned for the longer term together with a 70

hectare golf course.

As for us, we plan

to develop the peninsula as a secluded mixed-use nature

sanctuary, with 25 percent of unbuilt common area, such as a

tropical bird park, gardens & orchards, a turtle nursery, 10

kilometers of natural trails for trekking, horseback and bicycle

riding, etc... but also as a secluded accommodation area with

a few low-rise/low-density boutique hotels, and clusters of villas

for upper segments of the tourism and residential markets.

Once the nature sanctuary gets completed, 80% of its land is

expected to remain green/untouched.

For year 2020 a 750 kWp solar

farm

on 15 000 m2 of our land, is planned for

connection to the Indonesian electricity grid (called

PLN).

We also plan to invite guests,

young as well as young at heart, to the discovery of outdoor

activities on those untouched land & water such as horseback

riding, trekking, mountain biking, surfing, diving, snorkeling,

rock climbing, zipping, kayaking, kitesurfing, sailing & sea

safari.

Since sea turtles are often seen

on its reef, and got frequently eaten-up when occasionally

crawling onshore (till we bought farmers out, we mean), we

thought that naming this pristine place Turtle Reef is an

appropriate tribute.

LOMBOK'S TIME HAS COME

Since the closing of the domestic

Airport in the North of the island and the opening of the

International Airport in the South in October 2011, there is

too much to explain about the tourism potential of South Lombok in

general and Mandalika in particular. So we'll just mention here 4

points.

1) The International Airport is only 20

minutes away of Mandalika, and now receives direct foreign

flights from Singapore, Kuala Lumpur and Seoul with Perth,

Hong-Kong, Shanghai and Dubai announced for years

2017-2019.

2) Well in the trail of its

mature sister island Bali, Lombok received only 0.5 million

visitors in year 2010. However Lombok has received 2 million

visitors in 2015 and 3 million visitors in 2017 !!

3) Domestic flights from Jakarta,

Surabaya, Yogja, Makassar and noticeably from Bali 25 minutes

away, have doubled in frequency since the opening of the new

Airport, totalling 30 flights per day.

4)

Round the year, occupancies in the four and five star hotels of the

whole Lombok island are now at their 15 year peak (70% to 100%

occupancy).

Still clearly undeveloped

compared to Bali, South Lombok is THE FASTEST GROWING

destination for tourism in Asia (+30% of arrivals in 2013,

2014 & 2015!!).

Several interesting press

articles, such as collected here in the web site of Knight

Frank/Elite Havens, bring further information

why.

http://www.elitehavenssales.com/news/&tag=64

An April 2014's article from International

Business Times places the south coast of Lombok alongside Virgin

Galactic...

http://www.ibtimes.com/8-great-travel-destinations-near-future-1566060

A few December 2015 articles report on the

groundbreaking ceremony of five new luxury hotels on Mandalika

resort.

http://www.antaranews.com/en/news/102000/vp-kalla-reviews-preparation-to-build-hotels-in-mandalika

http://www.thejakartapost.com/news/2015/12/14/accorhotels-kicks-construction-mandalika.html

Three articles from Haute Residence, Latte

Luxury and Travel Weekly bring the last updates for year 2016 and

for early 2017 .

http://www.hauteresidence.com/beyond-bali-investors-set-sights-on-neighboring-lombok/

https://latteluxurynews.com/2016/09/09/plans-for-club-med-lombok-announced-by-ceo-and-founder/

http://www.travelweekly-asia.com/Travel-News/Hotel-News/Club-Med-moves-on-Lombok-project

OUR TURTLE REEF SANCTUARY

The six pictures below describe our nature

sanctuary in the midst of Mandalika.

OUR NATURE SANCTUARY

AS

THE MOST PROTECTED AND EXCLUSIVE LOCATION ?

If there is one day a Beverly

Hills in Lombok for luxury and

respect of

nature, it will arguably be Turtle Reef.

Pristine beaches, ornated by James Bond style

crags...

Breathtaking karstic cliffs hovering above

Mandalika...

Let's survey where else: Mandalika is all

government leaseholds. Mawun Bay would have been a

candidate however the Sampoerna tobbacco

group owning all

lands there seems more eager to

lease them to high-rise hotels. Finally, Selong

Belanak Bay is

equally beautiful, with freehold lands for

private

villas, but beachfronts there are notably prone to

ownership

disputes, hampered by a lack of legal roads and

are moreover one hour away from Airport and from Mandalika's

facilities.

POWERFUL NAMES, LEAN

BUDGET

In our search for a

first iconic hotel brand, we got warm replies of interest

from Ritz Carlton Reserve, Hyatt, Four Seasons, Sofitel and Oberoi

headquarters, all for the branding and management of the first

villa resort (15 to 20 year duration). Other luxury brands such as

Intercontinental, Hilton, Shangri La, Six Senses, Le Meridien...

can be approached as well.

Since this hotel will be the first on

Lombok island for those brands (at the exception of an Oberoi hotel

in the North of Lombok), they show higher

flexibility.

Most of them already agreed to operate

small-medium size (40-90 keys only), with controlled footprint and

responsible operational practices.

Then the land is also offered

under much sweetened conditions (read below).

Bottom line : the project will probably cost

20-30 MUSD only, while other branded projects at Bali, Phuket,

Maldives, etc... always cost between 75 and 200 MUSD depending

on land size and number of keys.

If they

wish to do so, foreign investors are welcome to stay, or even

relocate, in Indonesia to head monthly meetings with the hotel

management once the hotel gets in operation (resident

permits get provided for families).

INVESTMENT CAN PROBABLY BE CAPPED AT 20

MUSD

(Although a single ownership is

preferred, experienced hoteliers, environment leaders, as well as

financial investors, could possibly enter in the development from 3

MUSD upward)

The

hotel development needs the erection of 40-90 villas, mostly 1

bedroom plunge-pool villas with oceanview, on a 3-6 hectare

plot.

For instance,

50 villas

averaging 200m2 amount to 10 000m2 built, plus say 2 000m2

built for shared facilities (restaurants, lounge, spa) thus a

total of 12 000m2.

With prevalent upscale hotel construction rate

of 1 500 USD/m2 for top grade materials & interiors, inclusive

of architects fees , utilities, fittings and equipments, budget

will probably reach a value of 18 MUSD. You may desire to round it

to 20MUSD to include working capital and safety

margins.

Developers need to enter into discussion with

their architect to ascertain actual figures for the planned

resort.

Bank or contractor's loans can

possibly be obtained for, say 35% of the budget, once the foreign

investment company (called a PMA) has been registered with

the Indonesian ministry of Foreign Investment at Jakarta

(called BKPM).

SELLING VILLA UNITS ?

Some luxury brands such as

Sofitel, Six senses, Shangri La, Four Seasons welcome the sale of

villa units to individuals, prior and during the management

tenure.

From most sources, sale of 30% of villas units

prior and during the construction phase can cut the capital

requirement by more than 50%.

We

could thus feel comfortable with a conservative figure of 10 MUSD

of equities if this option is selected by the

developer.

Some other luxury brands like Marriott/Ritz

Carlton request that hotel developer's company retain full

ownership of hotel rooms during the duration of the management

contract. With those brands, villa units may only be sold as

additional private residences.

ONE EARLY BIRD GETS ALL THE

WORMS

As of

October 2018, market value of

oceanfront lands, with

freehold certificates, 25 minutes from International Airport,

neighboring the future Mandalika golf course & five star

hotels, gently sloping toward the sea and sunset, with

private roads avoiding village traffic, is above 285

Million Rupiah/Are (190

USD/m2).

Nearby, the Elite Havens & Knight Frank real

estate company just sold the balance of oceanfront lands of the

same Gerupuk/Tanjung Aan peninsula at 325 USD/m2.

As references, market price of

land at Kuta village of Lombok is now above 550 Million Rupiah/Are

(375 USD/m2), and this is for non-oceanfront...

As further references, market

price of oceanfront lands further away from Mandalika (7km westward

is Air Guling, 5km eastward is Bumbang) is 150-200 USD/m2 when

devoid of access uncertainties and ownership disputes.

As further reference, price

for 30 year leases on Mandalika is 90 USD/m2 (which would translate

into an equivalent price of roughly 270 USD/m2 if Mandalika lands

had been for sale).

For information of distant

readers,

beach-front and cliff-front lands at

South Bali nowadays command sky-high prices of 1500-5000

USD/m2. Traffic jams keeping increasing as well...

Back to our lands, at the

contrary of most other locations which never include an inch of

common space, we shall add the cost of protecting forever 25

percent of the land for common green/unbuilt areas. This comes at a

cost but is the only way to develop with exclusivity and privacy.

This increases land value to a minimum of 190 USD/m2 / 75% = 250

USD/m2.

To avoid valuation increases

during investor's evaluation and contract preparation,

let's freeze this value of 250 USD/m2 till January 2019 (since the

opening of the international airport,

South

Lombok's lands appreciate at a steady rate of 20%-30% per

annum).

MOREOVER, TO SHARE THE

BENEFIT of land owners (main founder of the PMA company, his

Indonesian family, and ISCO underpriviledged children foundation)

in enjoying the early development of a maiden

luxury-branded hotel within the nature sanctuary, let's provide a

price reduction of 50% on land acquisition, thus parting with land

at 125 USD/m2 only !

Or, if the overall

design you select with the international brand can fit into a 3

hectare plot, even parting with land for FREE

!!

Be it a 50% price reduction

on a 6 hectare plot or a "100% price reduction" on a 3 hectare

plot, our

incentive has a present value of 7.5

MUSD, probably rising above 15MUSD within the next 3

years.

The CEO and his family will

develop one midscale 50 key boutique hotel of their own, Net Zero

Energy, on a distant 4 hectare plot in 2019, however no other land

from Turtle Reef will be offered for subsequent hotel

developments before the 3 years following the actual

operations of the luxury hotels and golf course (2021+3

years=2024).

LAND COMPENSATION IS FLEXIBLE

1) For allocation of 6 hectares of land, a

developer opting to purchase the land needs a budget of 7.5 MUSD

only (market value being already 15 MUSD and rising fast toward 30

MUSD at time of payment and time of hotel opening !!).

(Sale of land can be legally discontinued, with

part of the 35% down-payment withheld as penalty, if developer

doesn't develop according to an pre-agreed schedule of 36 months,

plus time provision for force majeure, if any.)

2) Alternatively, if the

developer is foreign and insists for a local partner, the developer

can ask us to convert a 4.5 hectare land into shares of the foreign

investment company (payment of whole land is thus forfeited

since land owners then get shares of the hotel).

(By notarial deed, final land ownership

is completely granted to the hotel development

company when the villa resort gets actually developed and a

management contract with a luxury brand kicks off.

To prevent detrimental loss of time, a 1.75 MUSD

deposit/penalty needs to apply. It gets refunded 36 months later

when the branded hotel opens to the

public)

3)

Alternatively the developer can opt for a 20 - 50 year leasehold

contract, with 20 years at no cost (free use of up to 6 hectares of

land), plus a first right to renew the lease or to buy the

land. (To prevent detrimental loss of time, a

1.75 MUSD deposit/penalty needs to apply. It gets refunded 36

months later when the branded hotel opens to the

public).

4) Or simply opt for 3 hectares of freehold land

for free...

(To prevent detrimental loss of time, a 1.75 MUSD

deposit/penalty needs to apply. It gets refunded 36 months later

when the branded hotel opens to the public. Deposit is replaced by

a 35% down-payment when the developer opts to purchase extra land,

as on alternative 1) above.)

SUCCESS FEE

And if you aren't interested to develop the

hotel, we'll be glad to properly reward you for promoting this

opportunity to your friends or clients.

(Plus, by doing so, you help protecting against

over-development and help freezing 80% green one of the most

stunning place on earth. You also help financing the education of

more hard learning Indonesian children).

Please feel free to contact us at your

convenience for further details or discussion.

Pascal Lalanne

Managing director & founder of PT Lombok

Nature Sanctuary

contact@naturesanctuary.org

Founder (1999) and present chairman of Yayasan

Isco for education of underpriviledged children (2500 children

from 26 slums of Jakarta, Surabaya, Sumatra, Lombok, now 35+ at

state universities).

www.iscofoundation.org

Trade Advisor to the Embassy of France (Jakarta,

2002-2019)

www.cnccef.org

Villa Ambhara

Jalan Uluwatu, 80364 Bukit Jimbaran, Bali,

Indonesia

Tel (62) 361-703491

Fax (62) 361-703492

Mobile (62) 811 104 202 (Indonesia)

Mobile (33) 68085 2525 (France)